As you leaf through today’s newspaper, the resounding message is crystal clear: we’re facing a dire water crisis, and the urgency to address it is palpable as time ticks away.

India grew from merely 51 million tons (Mt) of food grain production in 1950/51 to over 314 Mt in 2022- a sixfold increase in production. What led to this remarkable outcome was the shift to science-led agricultural development, planner’s vigour and the dedicated effort of millions of farmers. This transformed India from an acutely food-scarce and food shortage nation to a food surplus and food exporting country.

However, these accomplishments came at a price- trading in water security, a resource even more essential for the survival of 1.3 billion people.

India has the highest demand for freshwater usage globally and extracts more groundwater each year than the US and China combined. 91% of this freshwater is used in the agricultural sector now, with groundwater contributing 62% of all irrigation water. Mismanagement, over-extraction, and inefficient irrigation practices have led to water scarcity in many regions. Moreover, climate change, growing population, and dependence on rain for replenishing these water reserves are not helping the case.

The issue operates in a dual manner: Inefficient agricultural practices contribute to water wastage, exacerbating water scarcity. Consequently, this scarcity threatens the future of agriculture, ultimately jeopardizing the livelihoods of 58% of the nation’s population that is currently dependent on it. This underscores the need for responsible water management.

But before this, we need to understand the science of agriculture.

Agriculture centers on the cultivation of soil, farming practices, and the nurturing of crops through irrigation. ‘Irrigation’ means supplying water to land to make it ready for agriculture.

Few crops require less amount of water for irrigation and few crops like rice, wheat, cotton, etc. require huge amounts of water for growth and are thus considered water-intensive crops.

Rice, wheat, cotton, and sugarcane represent 90 percent of India’s domestic production and take up more than half of India’s cultivable land. One of the key reasons for their higher production could be the most effective Minimum Support Prices (MSPs) support for these crops given by the government, leading to a disproportionate incentive structure favoring water-intensive crops.

An in-depth analysis of crop distribution across states highlights how suboptimal planting patterns exacerbate water stress. In Punjab, 117 out of a total 153 blocks are observed to have over-exploited groundwater- still the main cropping pattern is rice & wheat. Despite the significant water demand and shortage, Maharashtra contributes 22 percent of the nation’s total sugarcane output.

A classic example is the Marathwada district in Maharashtra, where water scarcity has intensified due to three consecutive poor monsoons. The farming patterns in the semi-arid region have changed in the past few decades. Many farmers in the area have shifted from drought-resistant crops such as jowar (sorghum) and chana (chickpea) to water-intensive crops like sugarcane, lured by government incentives. Marathwada gets about 844 mm of average rain annually, whereas sugarcane ideally needs 2,100 2,500 mm. Traditional crops like moong and maize require 3.5-7 million liters of water per hectare, while sugarcane demands a significantly higher amount at 25 million liters per hectare. But sugarcane farming continues despite the drought and the area under sugarcane cultivation has gone up from 167,000 hectares in 1970-71 to 219,400 ha in 2014-15.

Thus, growing a water-intensive crop in already water-stressed areas is a recipe for water famine.

There are two perspectives to consider when examining the solution:

• Government policy and interventions need to shift to reset the revenue balance in favor of other less water-intensive crops. Currently, the government asks farmers to shift to less water consuming crops, but it does little to support such a change. Fluctuating prices for vegetables, oilseeds, and pulses diminish the motivation for farmers to cultivate these crops.

• Technology & innovation to reduce water usage and wastage in water-intensive crops; and the ecosystem that is required to enable such innovation.

The nation has recognized that producing more from less is the key option to ensure sustainable development. Emerging technologies offer the ability to monitor, adjust, and promote more efficient use of water resources in agriculture. Further, these technologies should consider affordability by small holder farmers since they make up 86% of India’s farming households.

A perfect example of this is the Drip Pool Programme. This programme which was started in Gujarat, enables cotton farmers in India to use micro irrigation technology (drip irrigation) via community funding to provide interest-free loans to such farmers for adopting the technology. Programme farmers have reported using just 1,191 liters of water per kilogram of cotton, compared to the 5,923 liters consumed by non-programme farmers. They have also reported benefits such as uniformity in production, better yield of seed cotton and increased fertilizer cost efficiency as well as reduced weeding and lower labour costs.

However, sparking new innovations requires a village

Just as water is required for nurturing soil and seeds, so too are the enablers and ecosystem vital for propelling the technological revolution. There are four major facilitators of technology seeding:

1. Landscape of Research & Development- Research and development within an industry, and learning by doing, can lead to technological change. The maturity of R&D centers and their collaborative synergy play crucial roles in this process.

2. Spillover from other industries- Drawing knowledge and expertise from related/ similar industries, along with the ability to integrate platforms from diverse use cases nationwide, fosters a culture of hypothesis testing and prioritization for commercial viability.

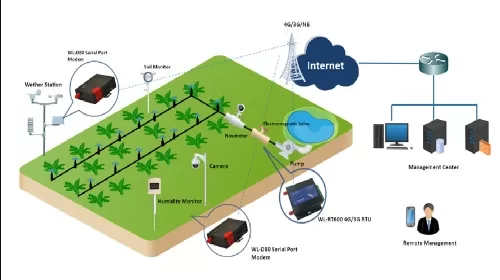

3. Information Technology Infrastructure- The effectiveness of existing technology infrastructure in swiftly and efficiently transferring data and decisions has accelerated the pace of technological shifts significantly.

4. Globalization- The increasing interconnectedness of the global economy and access to markets beyond local boundaries have transformed technology into a lever for scalability, thereby fostering innovation on a large scale.

Israel serves as an exemplary case of collaboration, transitioning from predominantly arid land to a global agricultural powerhouse. The key to this success lies at the combined role of government, market orientation and an innovative system focused on problem-solving. Its robust innovation ecosystem addresses challenges across the value chain for farmers and private stakeholders. A dedicated government R&D agency collaborates closely with extension workers, farmers, and the private sector, emphasizing the identification of real problems, tailored solution design, and adaptive capabilities through local R&D centers. Substantial investments in education and research have propelled Israel into a prominent global R&D hub, marking a significant leap in scientific innovation.

More emphasis on these enablers and ecosystem is a pathway to have more innovation and a nudge to more social entrepreneurs to come up with innovative ideas and technology. A few solutions that can be looked at going forward are:

• Advisory & Information Services: solutions that incorporate on-site data, precision agtech, and external information systems to improve decision-making

• Irrigation as a Service: a model that provides access to irrigation to those who do not own irrigation equipment.

• Irrigation Mechanisation/ Automation: solutions that provide machineries and automation technologies for irrigation.

• Agriculture Biotech: solutions that offer biotech/materials such as inputs, alternative ingredients, etc. to improve productivity and efficiency.

Conclusion

The water challenges currently confronting India are daunting, yet not insurmountable. There is an urgent need for sustainable and cost-effective technological innovations which addresses the water crisis. Equally important is the ecosystem and the enablers that nurtures and are the building blocks of such innovations. Coupled with meticulously executed government policies, this approach can undoubtedly assist India in overcoming its water challenges and also positively impact the livelihoods of the 58% of the nation’s population who depend on agriculture for their sustenance.

Indian packaged water market: Rising in the backyard

As per MarketLine, India’s packaged water market in 2022 was ~INR 905 Bn. The market is further estimated to grow at a CAGR of 10.3% to ~INR 1,480 Bn, till 2027. With a share of ~18% by value in 2022 in the APAC region, India is the 2nd largest and one of the fastest growing packaged water markets in the region, surpassing even China with respect to the forecasted growth rates.

The key driver for this trend is India’s rapid economic growth leading to rising number of corporate offices, increasing demand for MICE events and increasing end-consumer demand driven by rising disposable incomes, see graphs below for India’s per capita packaged water consumption trends and benchmarking with other countries.

Still, the share of packaged water within the overall drinking water consumed in India is very low. Assuming India’s population at 1.4 Bn. and average per capita drinking water requirement at 3 litres per day, the packaged water’s average share of the overall drinking water consumed would be ~1.5%.

From the outset, the future of the Indian packaged water market looks promising, but there are several challenges that persist today that may hinder its growth. These are as listed below:

• Too Many Players in a Small Market: Post Covid-19, there has been a general shift towards healthy consumption, with this trend seen especially amongst urban consumers. The marketing by prominent packaged water brands has been revolving around the theme of “healthy and hygienic bottled water”, thereby resonating well with these consumers. However, ~200 brands operate in this space in India and ~75% of the share by volume of packaged water consumed is dominated by small players. These small players have not been able to build the same amount of brand equity as built by their prominent peers, thereby leading to a pullback on the potential sales and therefore the market’s growth.

• Price Sensitive Market: Even with positive brand equity, other challenge is the average price per litre of packaged drinking water in the range of INR. 15-20 currently. While the price figure may look small, based on the household consumption expenditure survey for 2022-23, the average per day expenditures per capita in urban and rural areas are INR. 215 and INR. 125 respectively. Further, ~60% of the urban and the rural population spends less than their respective average per day per capita expenditures. With the expenditure basket consisting of essentials such as food, medical, conveyance, electricity, etc. the spending on packaged drinking water is far-fetched for a significant portion of the Indian population, let alone for the niche ones such as the packaged “natural spring mineral” water.

• Lacking Awareness on Multiple Product Offerings: While many of the consumers would perceive packaged drinking water positively over the tap water suited for average consumer might not be able to do so between packaged drinking water and packaged natural spring mineral water, even if sold by a leading player. Also, an average consumer is generally unaware of the nutritional benefits of these packaged products in terms of intake of calcium, magnesium, etc.

Today, Indian packaged water market stands at a juncture where strategic moves by its players can put it on an extremely, fast-paced growth trajectory. These are as listed below:

• Enhanced Focus on B2B Sales: The main distribution channel in the market is through on trade outlets, however retailers lack the brand loyalty in this market due to low switching costs for the customers. Thus, the companies can focus on strengthening their distribution network through partnerships with institutional buyers like hotels, restaurants, corporate offices, and educational institutions, which have a high and a consistent water consumption. Heavy focus on bulk supply agreements along with volume discounts can attract such customers. B2B sales also give opportunities to push niche products such as natural spring mineral water and therefore capture high margins.

• Targeted Promotion of Niche Products: Certain Indian companies offer natural spring mineral water bottled directly from ‘Himalayas’ and ‘Aravalis’. Highlighting the unique sourcing and superior quality of such products appeals to the premium consumer group. However, targeted promotional campaigns across the touchpoints of these customers are the key viz. premium hotels, malls, social media, etc., which thereby would lead to sales of high margin products.

• Scale-up Through Mergers and Acquisition: Today, multiple players exist, especially the regional ones, leading towards challenges in achieving benefits of scale through demand, especially for natural spring mineral water where logistics is a major cost. Acquisition of regional players would give big players the scale, along with making packaged water more affordable, and also relieving consumer trust deficit on quality and hygiene. Regional mergers or partnerships can also lead to similar benefits. These benefits will create a virtuous demand cycle as the different target segments would also come into the fold, such as the ones with less purchasing power.

• “Incubate” Streams of Ideas: Incubating new business concepts, piloting and roll-out/roll-off can be one of the diversification pathways beyond packaged water. For example, “mineral dosing” and “real time water quality monitoring” – already part of the packaged water production line – are some of the “services” that the players can plug out and evaluate for offering in the B2B format. Another huge opportunity area is replacing PET packaging of bottles with biodegradable packaging – still in its infancy. This is especially relevant as consumer participation is very critical for a successful recycle-to-reuse ecosystem, and the current levels of consumer participation in India in such initiatives are very low owing to the awareness challenge.

Favourable conditions and regulations position India’s packaged water market for an exponential growth phase. “Early movers” will dominate, grow alongside as the market evolves and will shape its future as well!